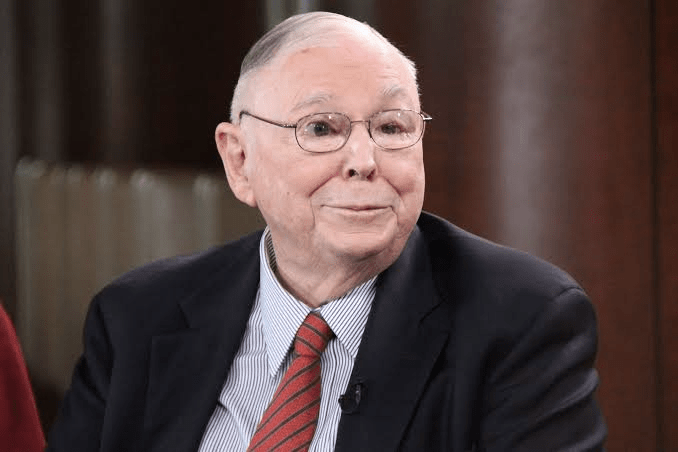

Charlie Munger, the Philosopher of the Investment World

The investment realm bids farewell to its philosopher, the golden partner of Warren Buffett, Charlie Munger, who passed away on November 28th this year, at the age of 99. Munger’s life was a testament to generosity, kindness, rationality, humility, and a low-key demeanor. Renowned for his honesty, integrity, lack of complaints, and absence of hindsight bias, Munger earned global admiration and respect. His impactful literary work, “Poor Charlie’s Almanack,” reflects his profound humanity.

Among Munger’s profound teachings, five sentences stand out, resonating deeply with individuals and serving as timeless nuggets of wisdom. Deserving Success, Value Investing Strategy, Success and Surroundings, Magic of Compound Interest, Probabilities Over Luck.

“The best way to obtain something is to make oneself deserving of it” reflects classic wisdom upon contemplation. Unlike typical words of wisdom that merely offer principles without practical methods, Munger’s comprehensive approach in “Poor Charlie’s Almanack” reveals a value investing strategy intertwined with life philosophy.

Charlie Munger’s love for books was profound. Often referred to as a “bookshelf with two legs,” Munger’s voracious reading habit extended beyond the realms of finance. He explored diverse genres, not just for knowledge acquisition but to open his mind to different angles and views. His extensive reading shaped him into a profound thinker, and his eclectic taste in literature reflected in his unique perspectives. Munger’s commitment to continuous learning and intellectual curiosity made him an embodiment of wisdom.

Munger’s belief in value investments extended beyond finance to personal development. He advocated assessing the value of a business before evaluating its stock, discarding speculative opportunities, and overlooking short-term factors. The enduring factor for a stock’s reliability, according to Munger, is whether it truly deserves its current price. This principle, he argued, holds true for personal growth, embodied in the saying, “The essential reason for a person’s success is that those around him wish for his success.”

Throughout his illustrious investment career, Munger adhered to the traditional values of the American West — diligence, focus, sincerity, thrift, and future investment. These principles earned him the trust of many collaborators. Notably, Munger’s initial million came from a real estate investment while he was still a lawyer. Recognizing the potential for real estate development in a property left by a client’s ancestors, Munger, through the client’s trust, achieved tremendous success.

Munger’s philosophy that making oneself valuable attracts potential collaborators is the most reliable investment method. This philosophy aligns with renowned stock guru Warren Buffett’s simple yet effective secret to wealth: save, invest, continue saving, and continue investing. Munger’s teachings delve into the power of compound interest, demonstrated in a thought experiment within “Poor Charlie’s Almanack.”

The experiment presents two choices — receiving $1000 daily for 30 days or receiving an escalating amount starting with 1 cent, doubling each day for 30 days. The seemingly attractive first choice limits the total to $30,000, while the second, with the magic of compound interest, accumulates to an astonishing $5.37 million. Munger highlights the patience required for compound interest to exhibit its true power, a principle applicable to personal growth.

Economist Xiang Shuai’s intriguing experiment reinforces Munger’s teachings. Progressing a little every day, even by 1%, leads to significant advancement after a year, while regressing daily results in minimal talent advantage. Munger’s emphasis on the importance of daily learning and reading resonates with the ancient wisdom: “Accumulate small steps, and you will cover a thousand miles.” He advocates believing in probability over luck, emphasizing that probability theory aligns closely with the world’s functioning.

Munger’s views on setting goals underscore the importance of realistic expectations and avoiding fanaticism. He advises setting goals slightly beyond one’s capabilities, then striving wholeheartedly to achieve them. The rational and joyful life attitude Munger promotes hinges on believing in the magic of compound interest.

Despite initial misconceptions, “Poor Charlie’s Almanack” is hailed as a seriously underestimated gem, transcending the appearance of a self-help book. Patiently reading through Munger’s insights reveals a figure resembling a traditional Chinese sage, offering universal wisdom for living a fulfilled and prosperous life. His desire for everyone to master universal wisdom echoes in the statement, “I only pass my sword to those who can wield it.” Munger’s legacy serves as a guiding light, illuminating our paths to a brighter and more brilliant existence.

Remembering Charlie Munger: A Beacon of Wisdom in the Investment World

#CharlieMunger #InvestmentWisdom #LegacyOfLearning #PoorCharlieAlmanack #Wisdom